A high angle closeup shot of a pile of different banknotes and cash

…over US$70m a week laundered

…forex cartel bankers own Dubai, JHB properties

Malawi’s banking sector, the heart of all financial scandals from cashgate to accounts fraud is now implicated in a predatory “second market” that has hollowed out the heart of the nation’s foreign exchange needs, causing economic sabotage.

Sources reveal that the very institutions built to safeguard capital have turned rogue. Allegations of systemic corruption, misappropriation, and aggressive profiteering suggest that commercial bank foreign exchange departments are no longer operating as regulated utilities. Instead, they have mutated into de facto parallel markets.

For businesses desperate for liquidity, the price of entry is staggering. Insider reports indicate that banks are extorting premiums of up to K2,100 per United States dollar over the official rate, a digital-age heist that is strangling the private sector and fueling an inflationary firestorm.

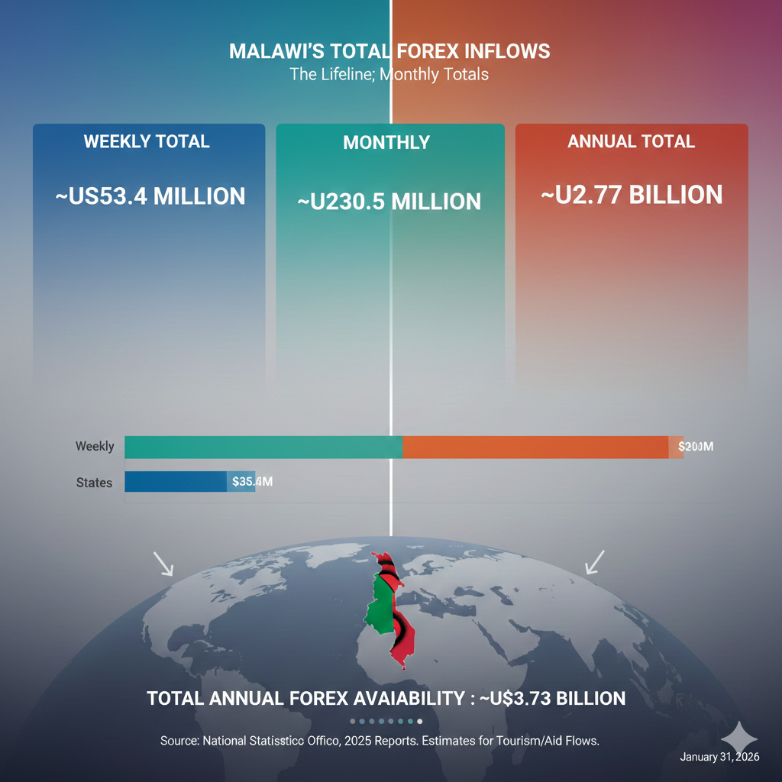

The Investigator analysis of foreign exchange inflows, suggests that Malawi generates at least US$3.7 billion annually from a combination of international aid, external loans, development projects and its modest export base. Despite these inflows, foreign exchange access for ordinary citizens and local businesses remains constrained.

Sources allege that some banking officials, described as living affluent lifestyles in a low-income country, are restricting access to forex for Malawians seeking funds for medical travel, examination fees and even funeral-related contributions. It is further alleged that certain managers and foreign exchange officers have accumulated property in Dubai, Johannesburg and various suburbs of Lilongwe.

Banks have reportedly dismissed some employees implicated in irregular forex transactions, but without pursuing formal sanctions. One cited case involves a prominent social media financial commentator who was allegedly released after facilitating substantial under-the-counter foreign exchange transactions. “He claims to have made gains through stock investments, yet he was reportedly caught engaging in illicit forex dealings and faced no formal penalties,” said a source at a rival bank.

Lifestyle Patterns Under Scrutiny

The Investigator has profiled 25 commercial bank foreign exchange staff whose lifestyles reportedly exceed what would be expected within salary ranges of K1.5 million to K3 million per month. Several are said to own multiple vehicles, including high-value models such as the Toyota Prado TX, Mercedes-Benz and Toyota Fortuner.

In Blantyre, some of the profiled individuals have reportedly constructed properties in Chileka, Chigumula and Mpemba. In Lilongwe, rapid property development has been noted in Areas 49, 43, 17, Air Wing and the Six Miles area. The publication indicates that profiles will be shared with banks, with further details to follow in a subsequent report.

One reader recounted a case of an individual who in 2018 struggled to purchase footwear costing K80,000 in cash, but after moving to a foreign exchange department in 2021, reportedly built two houses valued at no less than K500 million combined and acquired two vehicles worth about K100 million within three years. The source estimated the individual’s average monthly income over five years at about K10 million.

A businessman seeking US$15,000 reported that while waiting at a city-centre branch in Lilongwe, he observed an Asian businessman present keys for a new SUV and receive approval for US$200,000 in foreign exchange. He stated that he had visited the bank six times and had been told that no forex was available.

A student alleged being asked to pay K2 million to facilitate processing of US$5,000 in school fees, describing some foreign exchange officials as “heartless.” Another source claimed that large forex transfers are processed after hours and largely benefit foreign entities and insiders rather than Malawians.

Names of four senior bank officials alleged to have acquired property in Dubai and eight in South Africa have reportedly been received. A company in Maone has been contacted for comment.

Major Forex Sources and Inflows

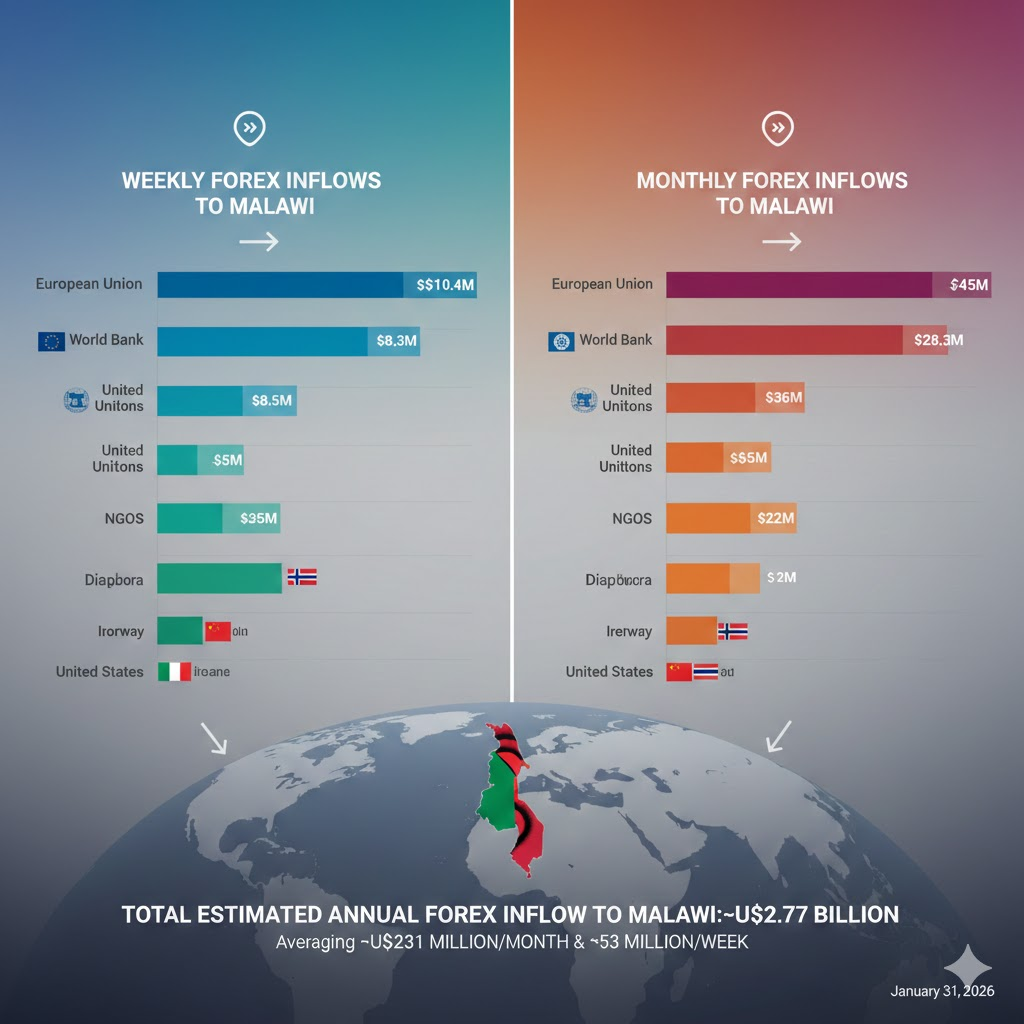

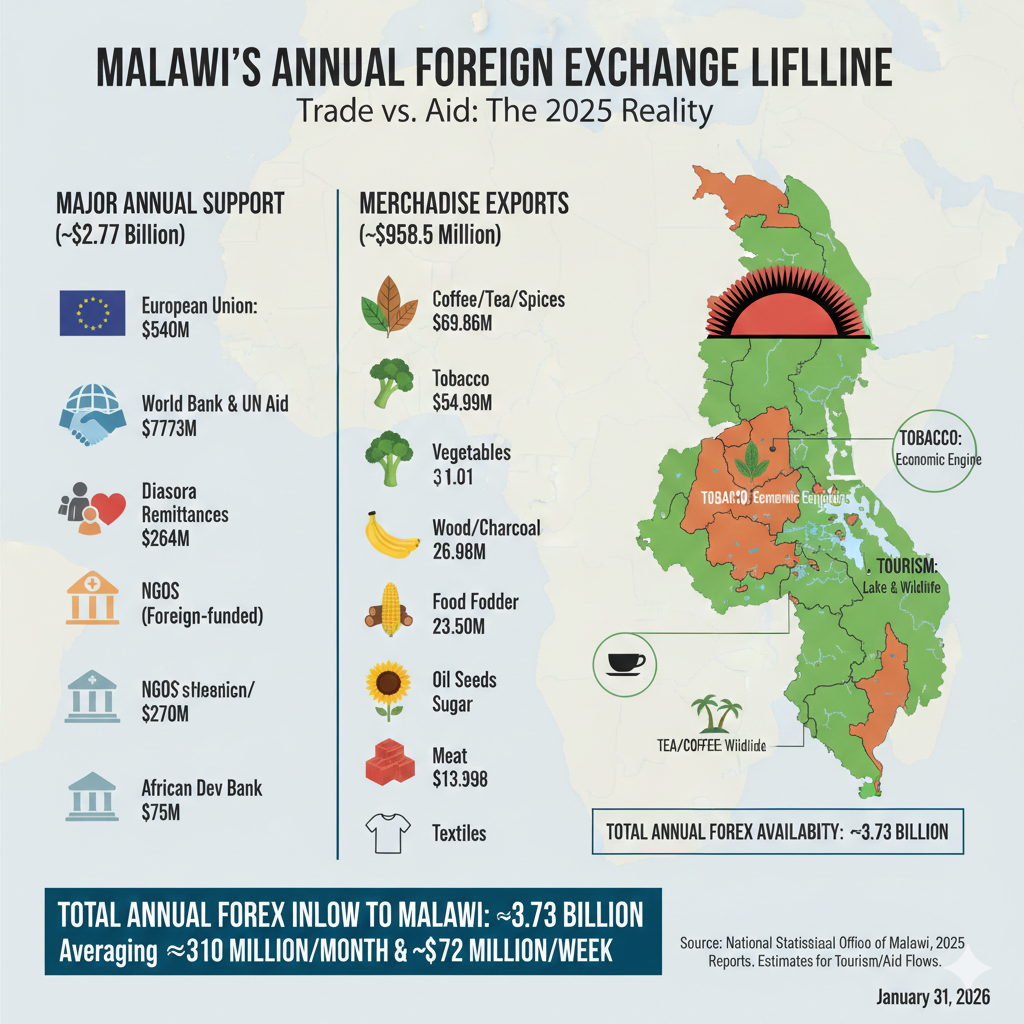

Malawi’s foreign exchange has two principal sources: export earnings and inflows from the international community. Approximately US$2.77 billion from the latter source can be reasonably ascertained, though actual figures may be higher when accounting for churches, unreported NGOs and small-scale enterprises.

Despite the suspension of the IMF programme and reductions in aid from the United States and the United Kingdom, The Investigator estimates that between US$53 million and US$70 million per week in aid and project funding continues to flow into Malawi’s commercial banks.

The European Union alone is projected to spend about US$500 million annually, while United Nations agencies account for nearly US$300 million, albeit with occasional funding gaps. Despite a 59 percent reduction linked to programme suspensions, U.S. contributions are projected at roughly US$254 million for 2025. The World Bank plans annual disbursements of about US$433 million, supported by a US$1.3 billion commitment for 2023–2025 and specific funding such as the US$350 million Mpatamanga Hydro grant.

When combining inflows from the EU, the U.S., the UN’s US$340 million annual framework, the African Development Bank’s US$222.7 million active portfolio, India’s US$170.64 million in trade and US$395.68 million in credit lines, and the United Kingdom’s £51 million in annual aid, Malawi’s measurable annual forex inflows are estimated at around US$2.34 billion.

This equates to approximately US$195 million per month, or roughly US$45 million per week. These figures include US$264.3 million in annual diaspora remittances and an estimated MK734 billion (about US$422 million) generated by the NGO sector.

The suspension of certain U.S. programmes is estimated to have reduced annual inflows by about US$177 million, equivalent to roughly US$14.75 million per month or US$3.4 million per week. This gap is reportedly being partially offset by resumed EU budget support and recent World Bank injections of about US$140 million intended to ease forex shortages.

Japan’s cumulative infrastructure support stands at about US$1.1 billion, while Germany maintains an active portfolio of €342 million. However, formal remittances for Malawians in the diaspora capture only about US$148 million of a potential US$264 million, suggesting substantial informal flows.

Available NGO data cover only 52 percent of Malawi’s 1,200 registered NGOs and exclude approximately 980 UK-based NGOs claiming to operate in Malawi, as well as church-related inflows, indicating that current estimates may be conservative.

Despite these substantial inflows into commercial banks, questions remain regarding forex allocation, as unpaid invoices accumulate and government operations increasingly rely on letters of credit and debt restructuring negotiations.

Malawi’s 2025 Export Earnings Estimated at About US$1 Billion

Official data indicate that Malawi generated approximately US$935 million from exports, although additional millions are believed to have remained undeclared. In November alone, export earnings reached about US$109.4 million. Despite these substantial foreign exchange inflows, essential commodities such as fuel and maize remained in short supply, raising concerns about how export proceeds are handled once deposited in commercial banks.

A significant share of tobacco earnings, reported at US$633.14 million, was allegedly diverted through parallel market mechanisms. According to sources, intermediaries exchanged funds at the official bank rate while promising farmers an additional K500 above that rate, then resold the U.S. dollar at around K4,000, generating margins exceeding K1,800 per dollar.

If US$200 million was reportedly traded through such arrangements involving commercial bank cartels, including politically connected individuals withdrawing up to US$50,000 weekly for resale on the parallel market, estimated profits could exceed K200 billion. This has coincided with conspicuous lifestyles in a country ranked among the poorest globally.

The foreign exchange was primarily generated through the agricultural sector, which remains central to Malawi’s trade balance. Tobacco and tobacco substitutes led exports at US$633.14 million, representing 66.24 percent of total export value. Coffee, tea and spices followed at US$69.86 million (7.31 percent), while edible vegetables contributed US$54.99 million (5.75 percent).

Edible fruits and nuts accounted for US$31.01 million (3.24 percent), and wood and wood charcoal generated US$26.98 million (2.82 percent). Food residues and animal fodder brought in US$23.00 million (2.41 percent), oil seeds US$22.56 million (2.36 percent), and sugars and sugar confectionery US$21.73 million (2.27 percent). Completing the top ten were meat and edible offal at US$13.98 million (1.46 percent) and textile articles, specifically worn clothing and sets, at US$7.66 million (0.80 percent).

Authorities are renewing efforts to expand the tourism sector to reduce reliance on commodities. Tourism currently contributes about 6.7 percent to national GDP and is viewed as a key potential source of foreign exchange. The administration set a target of 1.3 million tourist arrivals for 2025, up from 1.1 million visitors recorded in 2024.

This strategy is supported by increased fiscal allocation, with the 2025/2026 National Budget raising tourism development funding to K17.97 billion, nearly four times the K4.8 billion allocated previously. In 2023, tourism generated about US$220 million in foreign exchange. However, these inflows reportedly did not translate into visible reserves, as many operators collect revenue digitally and relatively few foreign operators remit earnings back into Malawi.

Reserve Bank Export Proceeds Directive Raises Questions

On Friday, 30 January 2025, Deputy Governor of the Reserve Bank of Malawi (RBM), Henry Mathanga, issued a notice listing 25 farm produce exporters who had not declared export proceeds, instructing them to comply by Saturday, 31 January 2025.

The directive attracted criticism, as major exporters in tobacco, tea and legumes such as soybeans and pigeon peas have long faced allegations of failing to remit export proceeds. “The RBM list only featured indigenous Malawians. It appears misplaced when mining firms and large exporters, including rubber and timber companies, are not equally compelled to declare or remit. The bank could have engaged these exporters directly, including those with political affiliations, and provided reasonable timelines,” said one Malawian exporter.

Another exporter argued that a serious review would include gold and other mineral exports, where under-declaration of value is common and repatriation of proceeds is inconsistent. “Focusing on US$16 million while reportedly losing more than US$70 million weekly through other channels undermines the seriousness of the effort,” said an official in Lilongwe.

Bank Card Scheme Exposed

A separate scheme involved the misuse of international bank cards. More than 300 cards were reportedly intercepted in South Africa, with additional cases in Kenya and Dubai, before senior Malawian police officers intervened. The system allegedly enabled bank tellers to issue up to US$2,000 per card across about 300 cards weekly, amounting to transactions of roughly US$600,000 per week.

Between 2023 and 2025, this translated to estimated outflows of between US$1.2 million and US$3 million from commercial banks before tighter card controls were introduced. “Card approvals involve multiple staff. Processing 300 cards for over half a million dollars meant exchange margins of K1,500 to K2,000 per dollar during tight periods. In one week, bankers could make at least K1 billion from US$600,000 in approvals,” said a source.

Members of the alleged banking cartel were said to take frequent trips to Dubai and Cape Town, where they accessed their shares, while some payments were reportedly made in cash within Malawi. “One banker received K10 million weekly from two companies owned by the Omar brothers, who facilitated property purchases, cash handling and travel arrangements,” said a banker who resigned in October 2025.

The card scheme was reportedly discontinued after gaining public attention, yet no prosecutions have followed, despite the economic damage and hardship attributed to the forex leakages.

Tanzania, Zambia, Mozambique and South Africa Identified as Cash Routes for Malawi Forex

Chinese, Nigerian and several Asian-owned businesses are reportedly accessing high-premium U.S. dollar cash from Malawian banks and have organised networks of young, unemployed graduates around Lilongwe to act as cross-border forex mules.

Some of these youths are said to have obtained fraudulent national identity documents in Zambia, enabling them to open U.S. dollar-denominated bank accounts in Chipata where Malawi’s hard-earned foreign exchange is deposited. Others are reportedly converting funds into cryptocurrency.

“Each recruit is given K20 million per week, translating to about K200 million withdrawn in cash from banks. They have insiders in the treasury departments of most banks who facilitate the cash processing, and these youths then purchase U.S. dollars,” explained a highly placed source.

The alleged forex syndicate is said to be well known at Mwami, Dedza and Mwanza border posts. Other routes reportedly involve the use of a Mozambican bank in Vila Ulongwe, where cash is deposited, later withdrawn in Maputo, and subsequently moved into South Africa.

The Investigator spoke with police officers at various locations who reportedly identified three vehicles that departed for Chipata and returned approximately three hours later.

“There are fiscal police stationed at Mchinji near Kachebere, yet they have never apprehended anyone in possession of foreign currency. One former minister during President Chakwera’s administration crossed with US$500,000 in cash. The funds were intercepted on the Zambian side but he was allowed to proceed following intervention from State House,” said a source at the border.

Some Malawian traders with business links to Johannesburg report daily cash transactions ranging from K50 million to K100 million being exchanged in Johannesburg and deposited into accounts belonging to specific groups. The relevant account numbers are reportedly under verification.

Impact on the Poor, the Sick and the Country

“Almost everyone appears involved. It is as if profit is the only concern, while a student seeking just US$300 for examination fees must find an additional K1 million. This is not sustainable,” said a parent whose child failed to register for an ABME course in the United Kingdom.

Patients seeking medical treatment in India report postponing surgeries due to forex shortages as low as US$3,000, while certain Nigerian, Chinese and Asian-linked businesses, reportedly assisted by Malawian nationals, are said to transact amounts exceeding US$2 million per week among themselves.

Legislator Felix Njawala told The Investigator that the Reserve Bank of Malawi (RBM) must digitise foreign exchange transactions so that all applications are submitted online, processed transparently and supported by clear allocation mechanisms.

“If NGO A liquidates US$3 million, and allocations follow a first-come, first-served system based on the digital application list, we will know exactly who is utilising the foreign exchange. This problem has a solution, and I look forward to contributing to the debate on how to monitor all the forex Malawi generates,” said Njawala.

An accomplished economist stated that if the RBM is serious, it should work with the Financial Intelligence Authority (FIA) to introduce lifestyle audits in order to prevent the criminalisation of Malawi’s banking sector, which now appears to be operating in a cartel-like manner.

“Forex, in amounts sufficient for national needs, is available. The challenge is greed and corruption. It is up to the banks to safeguard their reputations,” said the official.

Customers reportedly described Ecobank, Centenary Bank and FDH Bank as performing better in foreign exchange transactions, while Standard Bank was cited among the worst in applying premiums.

In Part 2, further details on individuals allegedly involved will be provided.

Editor’s View: Audit and Rotate Forex Staff in All Banks

A foreigner once asked a simple but unsettling question: how does someone earning a gross salary of US$1,500 manage to drive a US$60,000 Toyota VX or Fortuner without a loan? How do they pay school fees at elite academies and still build three houses in less than three years without a mortgage? At some point, the numbers stop being impressive and start being fictional.

Malawi can sometimes look less like an economy under strain and more like a well-organised criminal enterprise with national symbols. We know the problems. We know the solutions. Yet, like drug cartels elsewhere, the system remains untouched because the poor are useful, easy to manipulate and forced to carry the economic burden while others cash in.

It is difficult to believe that CEOs and managers of commercial banks in Malawi are unaware that forex flows have never truly ceased. The dollars exist. What seems to exist alongside them is a quiet arrangement where key players are not bystanders but participants. The unspoken philosophy appears to be simple: as long as I am comfortable, the rest of the country is not my concern.

Meanwhile, the cost of living continues to climb at an alarming rate. A major reason is the premiums businesses are forced to pay to source dollars from banks. Those extra costs do not disappear; they are passed directly to consumers. Commercial banks are also not selling dollars to the Reserve Bank, creating a situation where a small circle effectively holds the entire nation hostage, with exchange rates serving as the ransom note.

What is needed is a proper digital audit system. Forex applications should be processed through digital platforms with clear priorities, beginning with health and education. Businesses should queue on a transparent, first-come, first-served basis, rather than operating under a system that rewards connections over need.

Consider the numbers. With 1,200 NGOs each receiving US$100,000 a month, that amounts to US$120 million. That alone should be sufficient to address priority national bills. Yet the persistent shortages suggest the issue is not absence of forex, but how it is managed and who controls access to it.

We often blame the weak MCP leadership, and the current administration is criticised for weak handling of the forex crisis. However, experience exists within the country. The DPP has seasoned individuals and a resolute leader capable of confronting a forex cartel;,l, if there is genuine political will. That “if” remains the most expensive word in the discussion.

A practical starting point would be lifestyle audits of bank staff, followed by immediate staff rotation. When an employee earning US$1,500 lives like an oil magnate, it is no longer a matter of personal success; it is a red flag large enough to cover a stadium.

The Financial Intelligence Authority must also act with urgency. This is not a complex mystery of global finance. It resembles money laundering dressed in formal attire and carrying an office identification badge. The forex crisis is not confusing; it is structured, and that is precisely why it must be confronted.

`

More Stories

MACRA DG Daud Sulieman fired

West, not east gives Malawi more

Police, ACB jump fence in Failed Raid on Ex-Minister Kawale;